Why People Switch

Why Californians are Switching

from their CPAs to Thomas Tax.

Tired of waiting weeks for a reply?

Surprised by hidden fees?

Antiquated processes?

We reply same-day!

Transparent, fixed-fee pricing.

Digital Anytime Access

Why People Switch

Why Californians are Switching

from their CPAs to Thomas Tax.

Tired of waiting weeks for a reply?

We reply same-day!

Surprised by hidden fees?

Transparent, fixed-fee pricing.

Antiquated processes?

Digital Anytime Access

Who We Serve

Serving Busy Professionals, Self-employed, Creators, Entrepreneurs & Families.

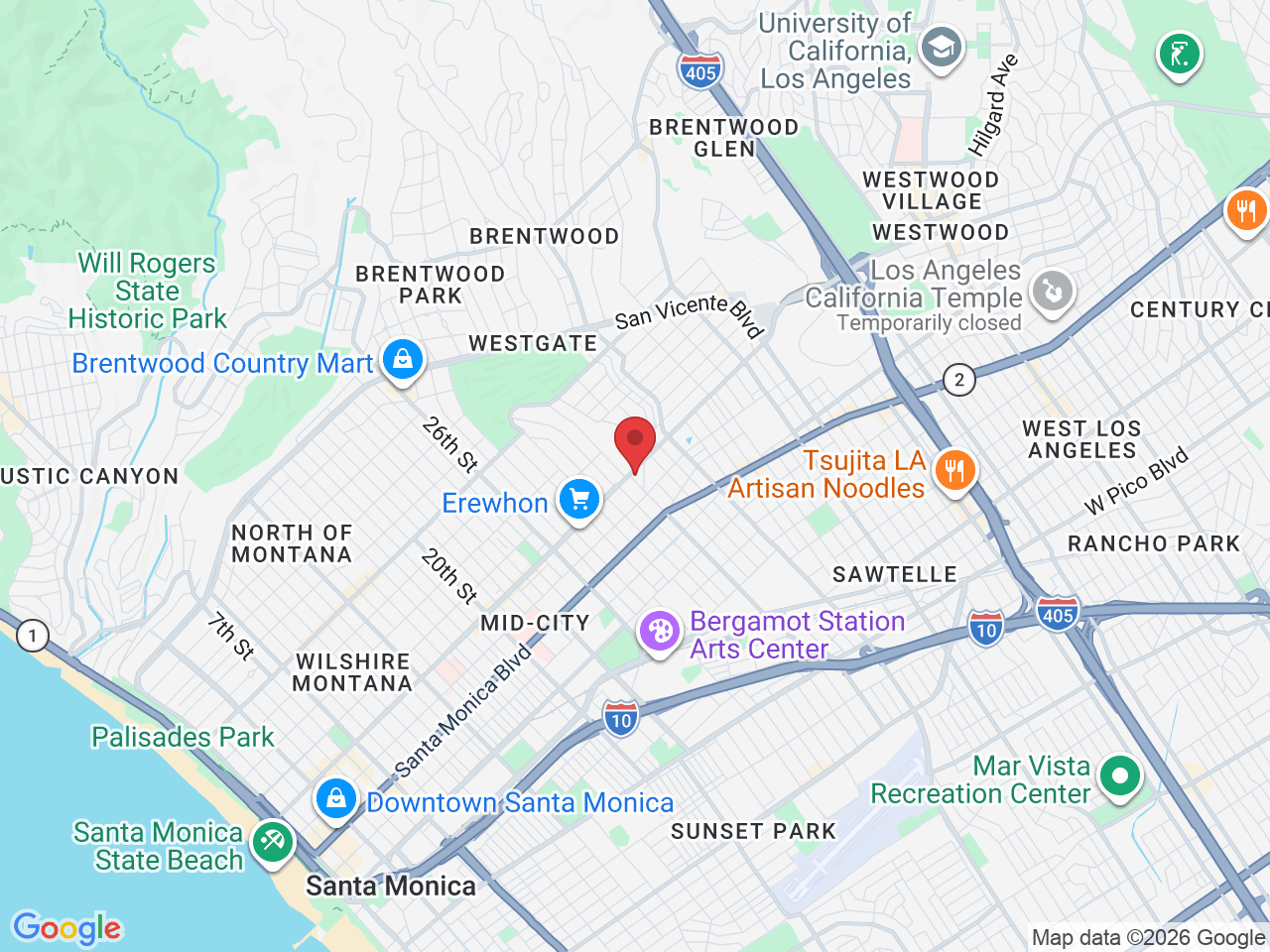

We know LA and we know your taxes.

Busy Professionals

Multiple W-2s, Schedule C income and expenses, rentals, equity compensation? We’ll handle it with precision and proactive care so you can focus elsewhere.

Self-Employed, Creators, and Entrepreneurs

Self-employed with 1099s and fluctuating income? Not sure what to do with your 1099-NEC? We get your world and industry-specific deductions.

Services & Pricing

Clear, Fixed-Fee Packages. No Surprises.

Most LA clients land between $875-$1,100

Standard Return

$875

Federal + CA return

W-2 income

Dependents

Itemized deductions (mortgage, charitable, medical)

Interest & Dividends

Accuracy Triple-Check

Same-day response guarantee

Discovery Call

Complex Return

$1,100

Federal + CA Return

All Standard Return features

Up to 5 of the following forms:

Brokerage Statements (1099-B)

Equity Compensation (RSUs, ISOs, NSOs, etc.)

K1's

Schedule C (Sole Proprietor)

Schedule E (including Rental properties)

Accuracy Triple-Check

Discovery Call

Advanced Return

Custom Quote

We will provide a personalized and fixed-fee price for your complex return.

Exclusions : No liens, no multi-year back taxes, no cross-border filings

Services & Pricing

Getting Started Is As Easy As 1-2-3

1

Book Your Free Consultation

schedule your complimentary tax readiness assessment online in 60 seconds

2

Upload Securely

secure easy-to-use client portal

3

File On-Time, With Confidence

proactive updates, same-day replies

Brian Thomas, Tax Expert

Testimonials

Don’t just take our word for it.

"Tax season is no longer a daunting, annual chore but an integral part of a continuous, year-long financial management process."

- B.D.

"I don’t have the nagging thought of having to reconcile expenses and the dread of tax season or fear that I might make too much and owe too much taxes."

- C.Z.

"Tax season transformed into a much more manageable and stress-free experience"

- C.S.

We deliver tax returns through a collaborative process led by Brian Thomas (California Tax Education Council Registered Tax Preparer #A355130) with participation from other staff members and partners such as Formations.

FAQs

Got Questions?

We’re here to help!

What is the October 15 tax filing extension?

If you live in Los Angeles County your tax deadline was automatically extended to October 15, 2025 because of the California wildfires. Read the IRS Notice here.

“Individuals and households that reside or have a business in Los Angeles County qualify for tax relief. The declaration permits the IRS to postpone certain tax-filing and tax-payment deadlines for taxpayers who reside or have a business in the disaster area.

Accordingly, certain deadlines falling on or after Jan. 7, 2025, and before Oct. 15, 2025, are postponed until Oct. 15, 2025.

As a result, affected individuals and businesses will have until Oct. 15, 2025, to file returns and pay any taxes that were originally due during this period.”

What happens if I miss the October 15 deadline?

Missing the October 15 deadline can result in significant IRS and state penalties, plus interest on any balance owed.

The IRS imposes both “Fail to File” and “Fail to Pay” penalties.

Can Thomas Tax Co. guarantee my return will be filed by October 15?

Yes—if we receive your complete documents by October 2, 2025 we guarantee on-time filing. If you delay, we can’t ensure timely submission. That’s why we encourage clients to book early.

Secure Your Spot

The October 15th filing deadline is around the corner. Don’t risk penalties.

12424 Wilshire Boulevard, Ninth Floor, Los Angeles, CA 90025

© Copyright 2026. Gambit. All Rights Reserved.